Sinking fund depreciation calculator

In the sinking fund method of depreciation a fixed depreciation charge is made every year and the interest is compounded on it annually. Result will be displayed.

How To Calculate Sinking Fund Method Of Depreciation Youtube

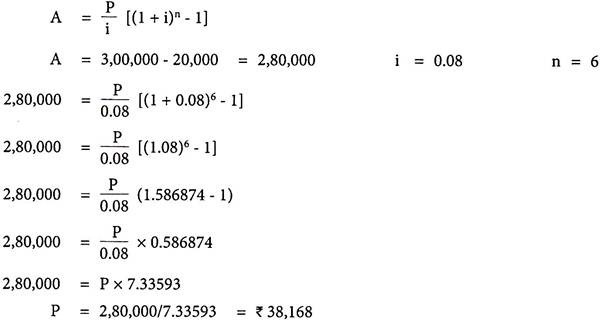

Purchase a machine on 01042012 on lease for 4 years for Rs 1000000-.

. For example for i 7 and N 5 years the sinking fund factor is equal to 01739. Enter your search terms Submit search form. For instance a widget-making machine is said to.

Sinking fund method is a method of calculating depreciation for an asset in which apart from calculating depreciation it also keeps aside a fund for replacing the asset at the end of its. How do you calculate sinking fund factor. Included now is our teachers.

Solves for various items using the sinking fund depreciation method including depreciation book value Asset Value Salvage Value. Sinking Fund Depreciation Calculator. Solves for various items using the sinking fund depreciation method including depreciation book value Asset Value Salvage Valuehttpswwwmathcelebrity.

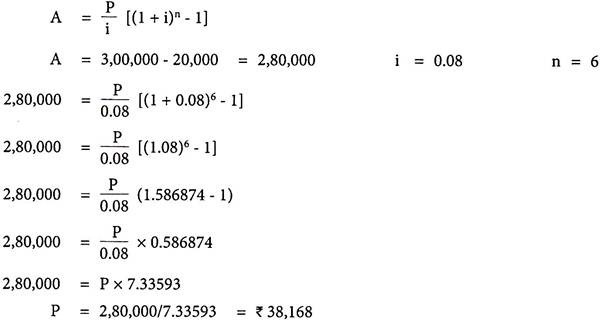

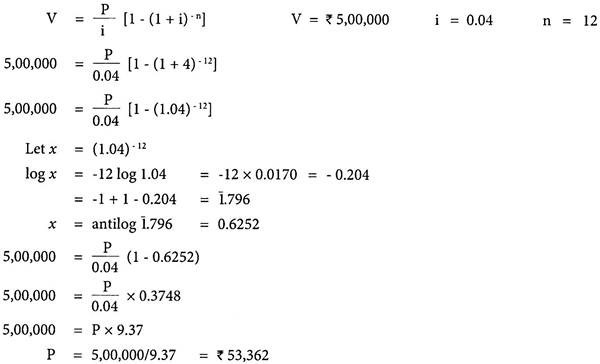

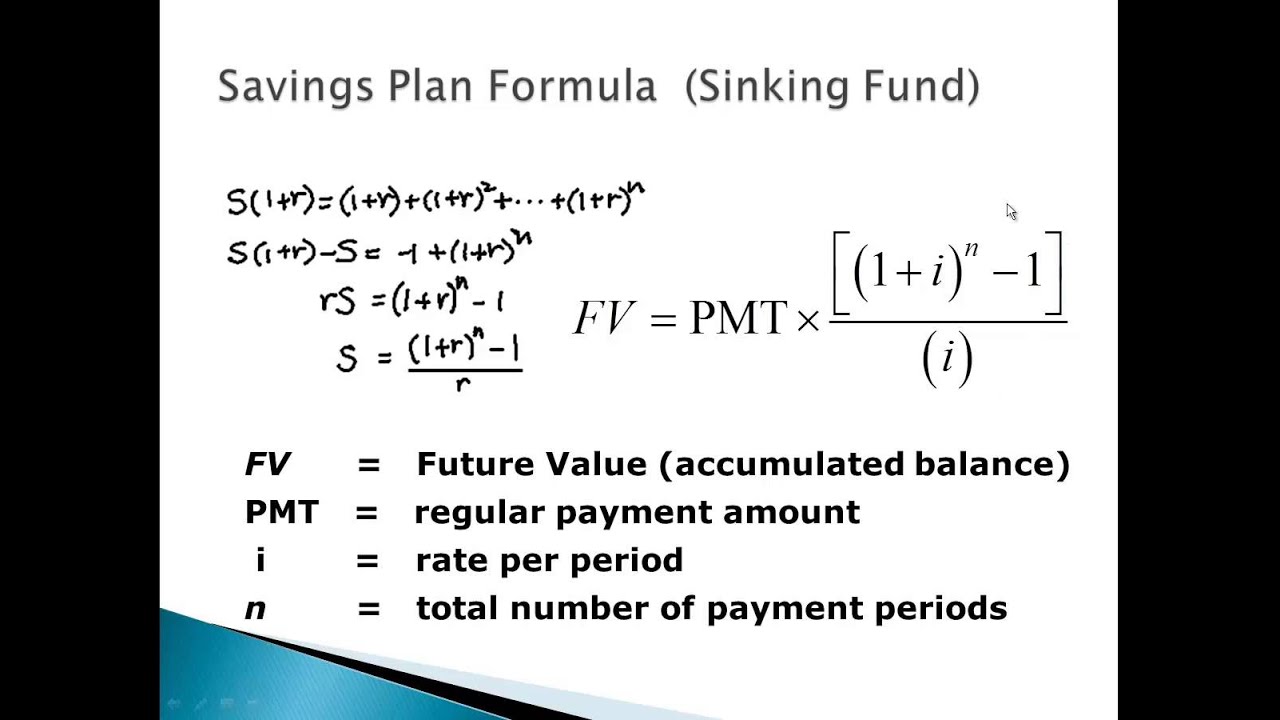

Sinking Fund A rm P P Periodic contribution to the sinking fund r Annualized rate of interest n No. The sinking fund method of depreciation is used when an organization wants to set aside a sufficient amount of cash to pay for a replacement asset when the current asset. Just enter your annual interest rates into the tool.

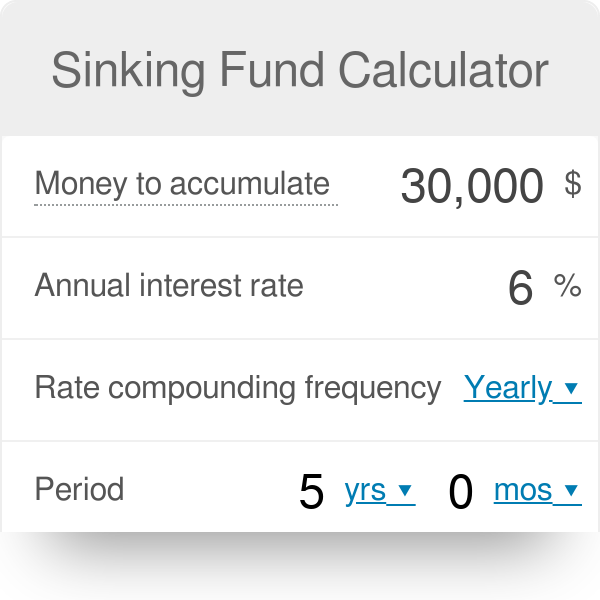

The sinking fund calculator will automatically calculate that amount for you. If we want to calculate the accumulated value in the sinking fund we can use the following formula. By request from MHF users and other folks Ive revamped this and have a version 20 which is much more user friendly and details more math.

A and B Pvt. A Money accumulated. Of payments per year.

Enter value and click on calculate. Using below data calculate. The sinking fund method of assets depreciation is ideally suited for plant and machinery as well as other wasting assets that require replacement.

How do you calculate depreciation in a sinking fund. It decided to provide cash for. A sinking fund is simply a strategic way to save money by setting aside a little bit each monthIn other words the amount you will need to contribute to a.

Sinking fund method is a method of calculating depreciation for an asset in which apart from calculating depreciation it also keeps aside a fund for replacing the asset at. P Periodic contribution r Interest rate. The sinking fund method of depreciation is used when an organization wants to set aside a sufficient amount of cash to pay for a replacement asset when the current asset reaches the.

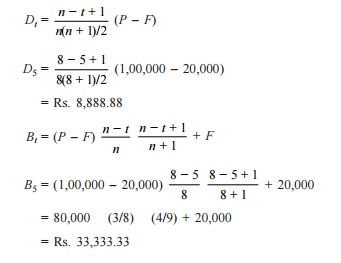

Example of the sinking fund method of depreciation. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Formula for Sink Fund Calculation.

Rate compound frequency how often the interest.

Salvage Value Formula Calculator Excel Template

Sinking Fund Method Of Depreciation Example Tutor S Tips

Lesson 13 2 Sinking Fund Method Sfm Depreciation Methods Engineering Economy Youtube

Sinking Fund Calculator

Salvage Value Formula Calculator Excel Template

Cash Flow To Debt Service Ratio Accounting Education

Sinking Fund Depreciation Method Calculator

What Is Sinking Fund How To Calculate It Youtube

Sinking Fund Method For Calculating Depreciation Qs Study

Calculation Of Amortisation And Sinking Fund Firm Financial Management

Methods Of Depreciation

Lesson 13 2 Sinking Fund Method Sfm Depreciation Methods Engineering Economy Youtube

Sinking Fund Method Definition Functions Formula Benefits

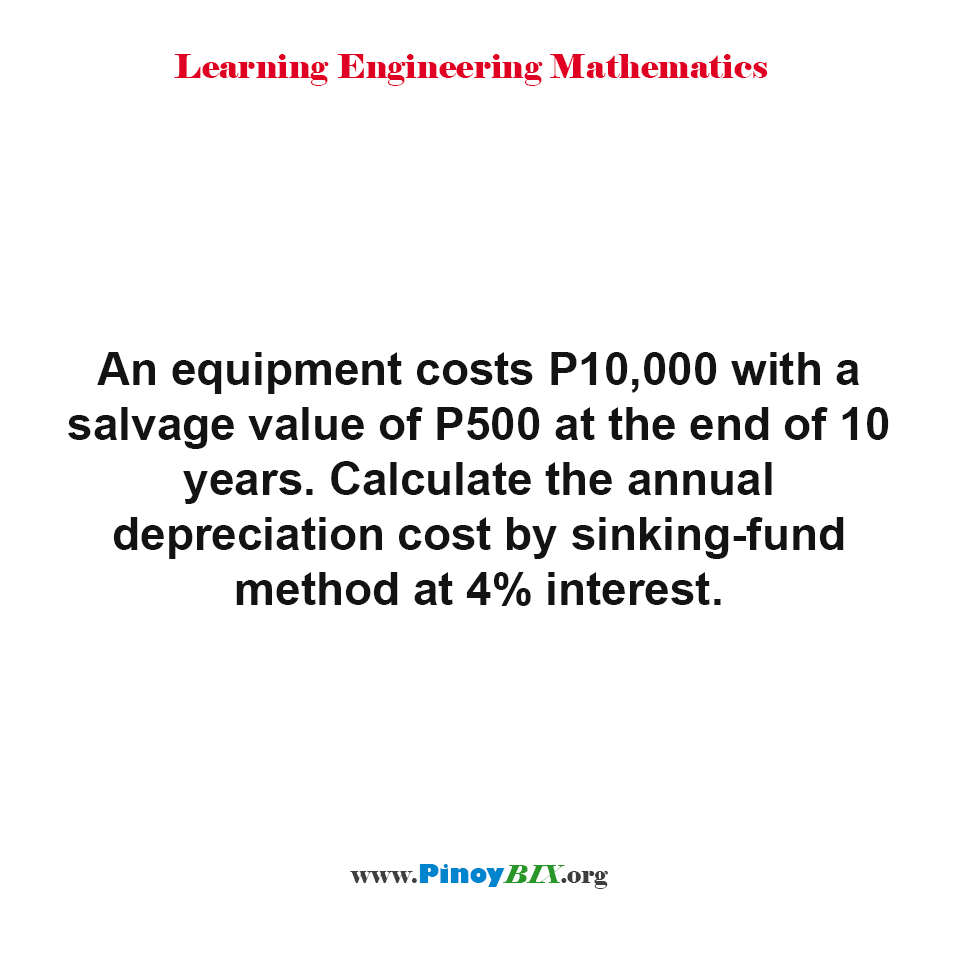

Solution Calculate The Annual Depreciation Cost By Sinking Fund Method At 4 Interest

Time Value Of Money Board Of Equalization

Calculation Of Amortisation And Sinking Fund Firm Financial Management

Introduction To Sinking Funds Youtube